Wir beschleunigen Forschung auf industriellen Daten

Von der Forschungsdienstleistung für anspruchsvolle KI-Projekte bis zur notwendigen GPU- und Cloud-Infrastruktur. Das SDIL als “Datenreinraum” und zertifizierter BDVA iSpace schließt die Lücke zwischen akademischer Forschung und Industrieproblemen durch einen datengetriebenen Innovationszyklus.

Innovation in Ihrem Unternehmen umsetzen?

Starten Sie Ihr KI-Projekt in einem Transfersprint.

Gefördert vom BMBF. Begleitet von der Spitzenforschung.

Bewerben Sie sich jetzt.

Smart Data

Innovation Services

Gefördert vom BMBF baut das SDIL momentan einen Katalog mit “Innovation Services” auf. Diese können Unternehmen und Behörden nutzen um KI-Innovationen schneller auf den Weg zu bringen. Dank Förderung sogar bis Ende 2024 kostenlos für insgesamt 15 innovative Mikroprojekte.

Die SDIL-Plattform

Das Smart Data Innovation Lab (SDIL) ist eine Austausch- und Betriebsplattform, um die Kooperation zwischen Wirtschaft, öffentlicher Hand und Forschung im Bereich KI, Big Data und Smart Data-Technologien zu beschleunigen.

Unternehmen und deutsche Spitzenforschungseinrichtungen haben sich im SDIL organisiert und einen Rahmen zwischen den beteiligten Partnern vereinbart. Das Konzept für SDIL wurde in der Arbeitsgruppe „Bildung und Forschung für die digitale Zukunft“ des Nationalen IT-Gipfels der Bundesregierung schon 2014 entwickelt.

Die SDIL-Plattform ist mittlerweile als “Datenreinraum” etabliert innerhalb dessen auf Hochleistungsrechnern und mit rechtlicher und technischer Rahmen beschleunigte Co-Innovationen vorangetrieben werden können.

Hierzu betreibt das Steinbuch Centre for Computing (SCC) am KIT beispielsweise einen GPU-Cluster und bietet modernste Software und Hardware. Abgerundet wird das ganze durch aktuelle Cloud-Angebote der beteiligten Softwarepartner, die Niederschwellig im vorwettbewerblichen Bereich genutzt werden können.

GPU Cluster

KI Cluster am KIT für Forschung auf Industriellen Daten mit 76 A100 GPU und Infiniband 100 Gbit Vernetzung

Datenreinraum

Sichere, zeitlich begrenzte Verarbeitung der Daten nach Bedarf on-premise am KIT oder bei Bedarf auch in der Cloud

Jupyter Lab

Interaktive sichere Python-Notebook-Umgebung mit vorinstallierter Software auf den Rechencluster

Vernetzung

Vernetzung und Einbindung der KI über Cloudressourcen

News & Events

WEB-SEMINAR: „KI und Nachhaltigkeit – AI and Sustainability“

In der heutigen Geschäftswelt sind Künstliche Intelligenz (KI) und Nachhaltigkeit mehr als bloße Schlagworte – sie sind entscheidende Faktoren für den langfristigen Erfolg Ihres Unternehmens. Möchten Sie erfahren, wie innovative KI-Technologien Ihre...

Smart Data Innovation Services: Edge and IoT Enablement for AI Applications

Datum: 14. Dezember 2023, 13:00 bis 16:00 Uhr Ort: online Diese Themen erwarten Sie: Vorstellung der Dienste von SAP und Software AG èFokus auf das Ausrollen von KI-Lösungen in der Anwendung Matchmaking und Diskussion mit KI-Anwendern: Produktion, Umwelt, Gesundheit …...

Unsere Referenzen

Von der Masterarbeit im Unternehmen, über den schnellen Forschungstranfer bis hin zum mehrjährigen kollaborativen Forschungsprojekt unterstützen wir KI-Forschung auf industriellen Datenquellen.

Optimierte Vorhersage des Defibrillationserfolgs mittels Few-Shot Learning

Mittels Few-Shot Learning soll eine präzise Vorhersage des Defibrillationserfolgs erreicht werden, um aussichtslose und damit potenziell schädliche Defibrillationen zu vermeiden.

SmartAPMotion

Die Fusion von maschinellen Lernverfahren verschiedene Sensor-Ströme und Datenquellen (unter anderem auch Video und Sprache) wird zur multimodale Aktivitätserkennung genutzt.

Conversational AI for Digital Twin

Nahtlos mit den Daten Ihres Unternehmens in natürlicher Sprache zu kommunizieren und datengesteuerte Entscheidungen zu treffen ermöglicht Ihnen der hier entwickelte KI-Assistent.

MangoTune: Adaption von CNN Modellen zur Reifevorhersage auf multi-spektralen Satellitendaten

Das Projekt bestimmt mittels KI-Analyse von multispektralen Satellitenbildern den Zeitbereich des Pflanzenwachstumsprozesses von Mangos weltweit und verknüpft das Ergebnis mit bestehenden Daten.

MAIWY – Erkennung von Weinblattkrankheiten mit KI

MAIWY strebt an, mithilfe von Smartphone-Bildern und künstlicher Intelligenz (KI) Rebkrankheiten, Mangelerscheinungen und Schädlinge bereits in frühen Stadien zu erkennen und zu differenzieren.

TruthfulLM: Verifying and Ensuring Truthfulness in Large Language Models

Die entwickelten Modelle extrahieren strukturierte Informationen aus Texten mit Hilfe derer generierte Texte automatisch mit einem Wissensgraphen abgeglichen und so auf ihren Wahrheitsgehalt überprüft werden können.

Feature Indexing für Parfumflaschen durch Deep Learning am Beispiel Parfümerie Pieper

Automatisierte Verbesserung der Parfümerie Pieper Produkt-Datenbank

WearNet: DeepLearning-Toolkit für Wearable-Bewegungsanalysen

Das Projekt befasst sich mit der Entwicklung modularer Deep Learning Systeme für Smart Clothing. Intelligente Kleidung, bei der die Elektronik in der textilen Struktur integriert ist, wird seit langem als zukunftsträchtig gesehen. Trotz des großen Interesses bleiben intelligente Textilien derzeit allerdings ein Nischenprodukt.

Chatbot Mining: Automatisierte Optimierung von Kundenservice-Chatbots

Kleine Energieversorger nutzen vermehrt Chatbots, doch mittelständische Unternehmen haben Probleme, die Chatbot-Daten zu analysieren, um ihren Kundenservice zu verbessern. Das Projekt zielt darauf ab, automatisierte Lösungen zu präsentieren, die die Potenziale dieser Daten erschließen.

Smart Air Quality Sensor Calibration

KI-gestützte Interpolation zur entfernten Kalibrierung von Feinstaub-Sensoren

TransPer: Transparente Personalisierung im E-Commerce

TransPer betrachtet Aspekte der Kausalität, Robustheit und Unsicherheit von KI-Anwendungen im industriellen Umfeld. Spezifischer Fokus: wie Produktempfehlungen im eCommerce-Bereich transparenter gestaltet werden können, um eine bessere Kundenzufriedenheit zu erreichen und die Einhaltung rechtlicher Vorgaben zu gewährleisten.

Verbesserung von KI Modellen basierend auf räumlichen Daten in der Agrarwirtschaft

Die Verbesserung der Bodenfeuchte-Vorhersagen für Heliopas durch eine effiziente Datenverarbeitungspipeline und Hyperparameteroptimierung

Nutzung maschinellen Lernens zur Zuordnung von Fragestellungen und Experten in Lernplattformen

Effektives Cognitive Matchmaking in Lernplattform-Communities: Untersuchung von LDA-Rec und SBERT-Rec Recommender-Systemen zur Experten-Fragen-Zuordnung

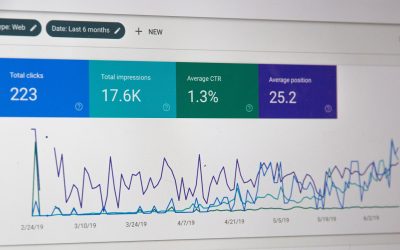

KI Modelle für Smart Cities am Beispiel Einzelhandel und Smart Parking in Dortmund

Die Erstellung eines flexiblen “Daten-Visualisierungs-Dashboards” und Vorhersagemodellen auf Basis von Autoregressionsmethoden

BERTI-4.0: Pre-trained Language Model für Conversational Agents im Kontext von Industrie 4.0

Intelligente Fabriken durch BERTI-4.0: Vortraining, Fine-Tuning und Evaluierung für Industrie 4.0 Sprachassistenzkomponenten

Nutzung von Quantum-Algorithmen für Konsistenzprüfung in Finanzberichten

Anwendbarkeit von Quantum-Computing auf Finanzberichte für effiziente Konsistenzprüfung

SDCS-BW: Price Intelligence

Die richtigen Algorithmen für erfolgreiche Multilabel-Produktklassifizierung aufspürt

Risk Management 4.0

Maschinellen Lernens zur vorausschauenden kausalen Analyse von Risikofaktoren über Investmentportfolien

„Cognitive Assistant“

Service-Assistent für Steuerberater, Wirtschaftsprüfer und Rechtsanwälte bei DATEV

SIS Software

Vorhersagen von Personenströmen, wenn nur kurzfristige Trainingsdaten zur Verfügung stehen

SDSC-BW: EDI

Die Position der Bemaßung detektieren und die Winkelinformationen der detektierten Positionen bereitzustellen

Verteilte Auswertung von hochdimensionaler Messdaten

Verteilte Auswertung hochfrequenter Messdaten aus der industriellen Fertigung für Qualitätsoptimierung und Condition Monitoring

SDCS-BW: ArtiMinds

Die Beziehung zwischen Startposition, Suchbahn des Roboterarms und durchschnittlichem Zeitaufwand

SDCS-BW: Schlötter

Intelligente Verkaufsmengen vorhersagen, um die durch ungenaue Prognosen verursachten Verluste zu verringern

Fraunhofer IOSB-INA

Evaluation von Verfahren zur automatischen Rekonfiguration von Transportdrohnen

E-Scooter Detection

Entwicklung neuer Technologien für die infrastrukturseitige Erfassung von Verkehrsdaten

SDSC-BW: Börse Stuttgart

Besseres Verständnis für komplexe Trading-Aktivitäten dank Transaktionsanalyse

SDCS-BW: Ensinger

Der ersten Schritt für eine bessere Verkaufsvorhersage, um mögliche Engpässe an heißen Tagen zu verhindern

QuestMiner

Erkennung und Bewertung von Anomalien in Grafiken

Churn-Warnsystem

Präzise und zeitnah Vorhersagen zu treffen, so dass das Unternehmen ausreichend Zeit hat, seine Kunden zu halten

SDSC-BW: Hectronic

Mit Smart-Data-Analysen verunreinigte Tankfüllstände frühzeitig erkennen

STEP

Ein Simulationsmodell für die Technikereinsatzplanung und Optimierung der Technikerrouten

SDCS-BW: BIA Forst

Eine Methode zur Ermittlung von Soll-Werten zur Verringerung der Schadenanzahl zeigen

SDCS-BW: BrandGroup

Eine genauere Einstellung der Messmerkmale und eine frühzeitige Identifizierung von Qualitätsabweichungen

SDSC-BW: LGI

Smarte Versandvolumenvorhersage mit KI-Modellen

SDCS-BW: DEHA Gruppe

Eine automatisierte Auswertung der Transaktionsdaten

BigGIS

Big Data und der Fusion unsicherer, geografischer Daten

SDSC-BW: Coral

Wissen besser vernetzen -Implementierung einer neuronalen Active-Learning-Netzwerkarchitektur

SDSC-BW: Vitra

Absatzprognosen von Form und Farbe – ein Vorhersagemodel auf Basis der Vertriebszahlen

billiger.de

Analyse von Nutzerverhalten basierend auf Web-Protokoll-Daten

SDSC-BW: Mader

Vorausschauend die Energieeffizienz steigern – eine energieeffiziente Optimierung des Kompressors

Transforming-Transport

Transforming Transport vereint Wissen und Lösungen großer europäischer ICT- und Big-Data-Technologieanbieter

Trelleborg Sealing Solutions

Zustandsüberwachung und -vorhersage von Dichtungssystemen

SmartAQnet

Entwicklung eines intelligenten, reproduzierbaren Messnetzwerkes in der Modellregion Augsburg

SDSC-BW: Erdrich

Dynamische Maschinenplanung mit Smart-Data-Technologien

OSRAM

Aus der Datenauswertung können Prognosen und Regeln für die Produktion erstellt werden

Erweiterung der ITS

Verbesserung der Verkehrsflussvorhersage mit Umgebungsmodellen

All-Time Parts Prediction

Lieferkette aufzubauen mittels IBM SPSS Modeler, kombiniert mit IBM SPSS CADS, Python und R-Komponenten

SDSC-BW: Streit

Von Daten zur Holzqualität über entstehende Daten an der Sägelinie bis hin zu den Verkaufsdaten

SDSC-BW: da-cons

In den Bilddateien Pflanzen zuverlässig zu erkennen

John Deere

Reduzierung der Nacharbeit und die Vermeidung von Fehlern bei der Fertigung von Traktoren

KIT-Facility Management

Bedarfsanalyse für energetische Baumaßnahmen auf Basis historischer Infrastrukturdaten

SDSC-BW: Dr.Hartmann

Smart-Data-Analysen für industrielle Prozesswassersysteme – Genauigkeit von mindestens 95% erreicht

SDSC-BW: Sedus

Prognosen für die Produktionsmengen von spezifischen Ausstattungsvarianten

SDSC-BW: Echobot

Die richtigen Algorithmen bei Big-Data-Projekten – sowohl hardware- als auch softwareseitige Optimierungspotentiale

SAP – Datenalyse

Untersuchung verschiedener Big Data Plattformen hinsichtlich ihrer Performance bei forensischer Datenanalyse

MedTrend1

Intelligente Datenvorhersage von Trends in der Medizin.

SDSC-BW: FUCHS

Auf der Suche nach unbekannten Korrelationen, um Optimierungspotenziale aufzuspüren

SDSC-BW: Hermle AG

Smart Data reduziert Wartungsintervalle von Fräsmaschinen

VDAR

Verteilte Dezentrale Autonome Regelungssysteme für Dezentrale Energiemärkte

SAP

Assoziationsregeln für Hochdimensionale Stammdaten

TRUMPF

Analyse hochvarianter, zeitlich dünn besiedelter und unmarkierter Datensätze zur Durchführung zustandsbasierter Wartung

SmartFactoryKL

Prädiktive Instandhaltungsdatenanalyse anhand SmartFactoryKL-generierter Daten

SDI-X

Smart Data Innovation-Prozesse, -Werkzeuge und -Betriebskonzepte

SDSC-BW: Rolf Benz

Potentialanalyse Lederverschnittoptimierung – eine automatisierte Aufstellung und Überprüfung von Hypothesen

SDSC-BW: Huber

Smart-Data-gestützte Kampagnen-Analysen für das Marketing – zukünftigen Marketingaktionen

ABB

Assoziationsanalyse für datengetriebene Dienstleistungen auf Basis Industrieller Log-Dateien

Smart Brain Data Analyse

Ansatz zum maschinellen Lernen für eine Hintergrundsegmentierung des 3D-Bildvolumens eines Gehirngewebeblocks

SDSC-BW: Herrenknecht

Smart-Data-Algorithmen unterstützen, bei der Planung die Liefergenauigkeit

SDSC-BW: Bilcare

Smarte Sensordaten unterstützen die Fertigung von Verpackungslösungen

KIT

GPU + In-Memory-Datenmanagement für Big Data-Analysen

Smart Data-Technologien

Smart Data-Lösungen für den produzierenden Mittelstand in Baden-Württemberg